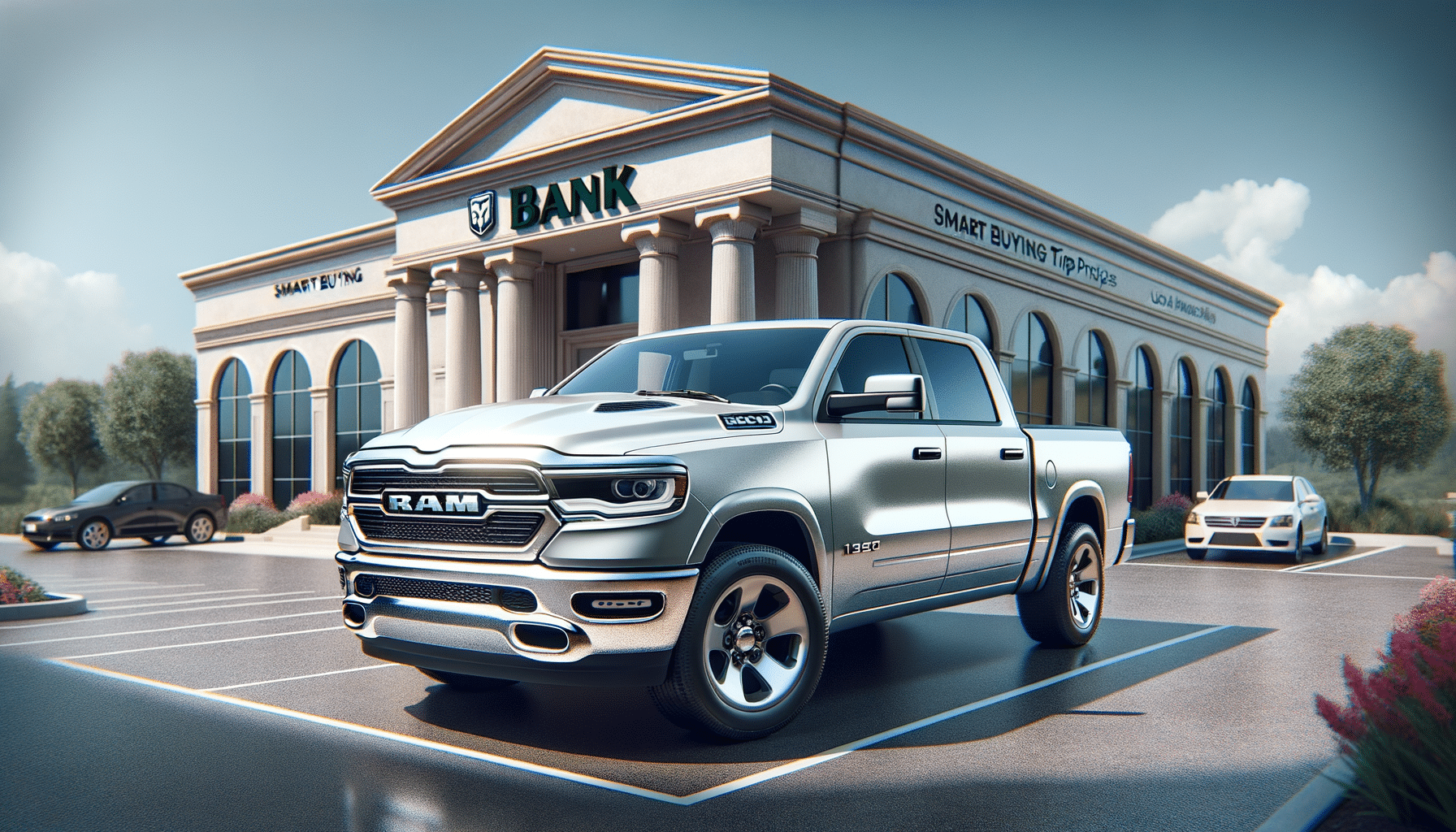

The Insider’s Guide to Bank-Owned RAM 1500: Tips for Smart Buyers

Introduction to Bank-Owned RAM 1500

Purchasing a bank-owned RAM 1500 can be a savvy move for those looking to combine quality with cost-effectiveness. These vehicles are typically repossessed due to the previous owner’s inability to meet financial obligations, meaning they often come with a lower price tag. Understanding the nuances of buying a bank-owned vehicle is crucial, as it involves different considerations compared to purchasing from a dealership or private seller.

Bank-owned vehicles can offer excellent value, but potential buyers need to be aware of the unique aspects of this market. From understanding the condition of the vehicle to navigating the purchase process, being informed is key to making a smart purchase. This guide will walk you through the essential steps and considerations involved in buying a bank-owned RAM 1500.

Evaluating the Condition of a Bank-Owned RAM 1500

One of the first steps in purchasing a bank-owned RAM 1500 is evaluating its condition. Since these vehicles are repossessed, they may not always be in pristine condition. Here are some tips to help you assess the vehicle’s state:

- Inspection: Conduct a thorough inspection of the vehicle. Check for signs of wear and tear, such as dents, scratches, or rust.

- Mechanical Check: Have a trusted mechanic examine the engine, transmission, and other vital components to ensure they are in good working order.

- Service Records: Request the vehicle’s service history to understand its maintenance background and any potential issues.

By carefully evaluating the condition, you can avoid unexpected repairs and ensure that your investment is sound.

Understanding the Purchasing Process

The process of buying a bank-owned RAM 1500 is distinct from traditional car buying. Here’s what you need to know:

- Bank Auctions: These vehicles are often sold at auctions organized by the bank. Attending these auctions can provide access to competitive prices.

- Bidding Strategy: Develop a bidding strategy to avoid overpaying. Set a maximum budget and stick to it.

- Documentation: Ensure that all necessary paperwork, such as the title and registration, is in order before completing the purchase.

Understanding these steps can help you navigate the process smoothly and secure a great deal on your RAM 1500.

Identifying Potential Issues

While bank-owned vehicles can be a great deal, it’s important to identify potential issues that may arise. Consider the following:

- History of Use: Determine how the vehicle was used by the previous owner. Was it a personal vehicle or used for commercial purposes?

- Accident Reports: Check for any accident history that might affect the vehicle’s performance or value.

- Recalls: Verify if the vehicle has any outstanding recalls that need to be addressed.

By being aware of these issues, you can make a more informed decision and avoid potential pitfalls.

Conclusion: Making an Informed Purchase

Buying a bank-owned RAM 1500 can be a rewarding experience if approached with the right knowledge and preparation. By thoroughly evaluating the vehicle’s condition, understanding the purchasing process, and identifying potential issues, you can make a confident and informed decision. These steps not only ensure a wise investment but also provide peace of mind, knowing that you’ve secured a quality vehicle at a reasonable price.

For those in the market for a RAM 1500, exploring bank-owned options can be a financially savvy choice. With the insights provided in this guide, you’re well-equipped to navigate this unique market and drive away with a vehicle that meets your needs and budget.